MESA SOFTWARE

LEFT-BRAINED CONCEPTS FOR TRADERS IN THEIR RIGHT MINDS

John Ehlers

AT A GLANCE

TRADING

President of MESA Software

Chief Scientist of StockSpotter.com

Contributing Editor of Stocks & Commodities

MTA’s Charles H. Dow Award

S&C 2015 Readers’ Choice Award

Judge for NAAIM Wagner Awards

Developed the MESA algorithm

R-MESA was a top 10 system for 10 years

Invented SwamiCharts

Author of four books

EDUCATION

BSEE & MSEE University of Missouri

The George Washington University

….Majored in Fields & Waves

….Minored in Information Theory

Emeritus Member, Sigma Xi

….The Scientific Research Honor Society

ENGINEERING

Retired from Raytheon as Sr. Engineering Fellow

Designed the data transmitter for SkyLab

Top 100 Products of 1976

….Industrial Research Magazine

Designed precision surviellance receivers

Systems Engineer for:

….AN/SLD-1, Navy’s First Direction Finder

….AN/ALQ-184 Radar Jamming Pod

….AN/ALE-50 Towed Decoy

….SR-71 Self-Protect Suite

….MALD (Miniature Air Launched Decoy)

CIVIC

President, Cambria Historical Society

Adjutant, American Legion Post 432

Rotary

MY STORY

My professional story starts when I enlisted in the USAF to become a pilot during the Korean War. There, I was exposed to electronics and became absolutely fascinated with it. So, when I was discharged I changed college curriculums and got my BSEE and MSEE from the University of Missouri. I started as an antenna engineer, designing antennas for the B-52. I moved near Washington D.C., where I designed the Navy’s first shipborne antisubmarine Direction Finder. That antisubmarine technology is still used today in the LAMPS helicopters. In my spare time I studied for my Doctorate at George Washington University. I participated in the design of an Identification Friend or Foe (IFF) system that used the Fourier Transform of radar echoes from the fan blades of jet engines to uniquely identify various aircraft. My equipment was large, but the IFF system exists today on F-18s in the form of software. I designed a range of electronic filters and the data transmitter for SkyLab. As an entrepreneur I designed a residential fire alarm based on a semiconductor detection of hydrocarbons because I thought a radioactive ionization approach would never be approved. Boy, was I wrong on that one! So, I repurposed my semiconductor inventory to a sensitive gas leak detector that acted like a geiger counter. Industrial Research Magazine awarded the gas leak detector as one of the 100 best new products of 1976. I became Director of Engineering for Norlin Communications, developing precision surveillance receivers for Government Agencies and foreign governments. For example, these receivers were used to chase down pirates in the Strait of Malacca. In 1980 I joined Raytheon, and was the system engineer on a wide variety of Electronic Countermeasures Systems. I retired from Raytheon in 2005 as a Senior Engineering Fellow.

So, what does this have to do with trading? Not much, except I could apply my signal processing skills to the art of trading.

In 1978 Maximum Entropy was an advanced mathematical technique used in the seismic exploration for oil. The advantage of this approach was that only a short amount of data is required to attain a high resolution answer. I recognized this could be important for processing market data because the market cycles are efemerous, and using a short data sample could result in a more accurate measurement of the cycles in the market. Also, I recognized the changing cycles invalidated all the FFT data assumptions. I therefore adapted the Maximum Entropy to develop the MESA (Maximum Entropy Spectrum Analysis) product. In doing this, I scaled the result in terms of cycle period with which traders are familiar instead of the usual frequency axis. I developed MESA for my own use as a private trader, but word soon got out, and before I knew it I was a vendor. MESA is acknowledged to be the leading method of measuring the market spectrum. MESA was used not only as an indicator, but the measured dominant cycle was used to dynamically tune trading strategies such as EPOCH and SIERRA HOTEL.

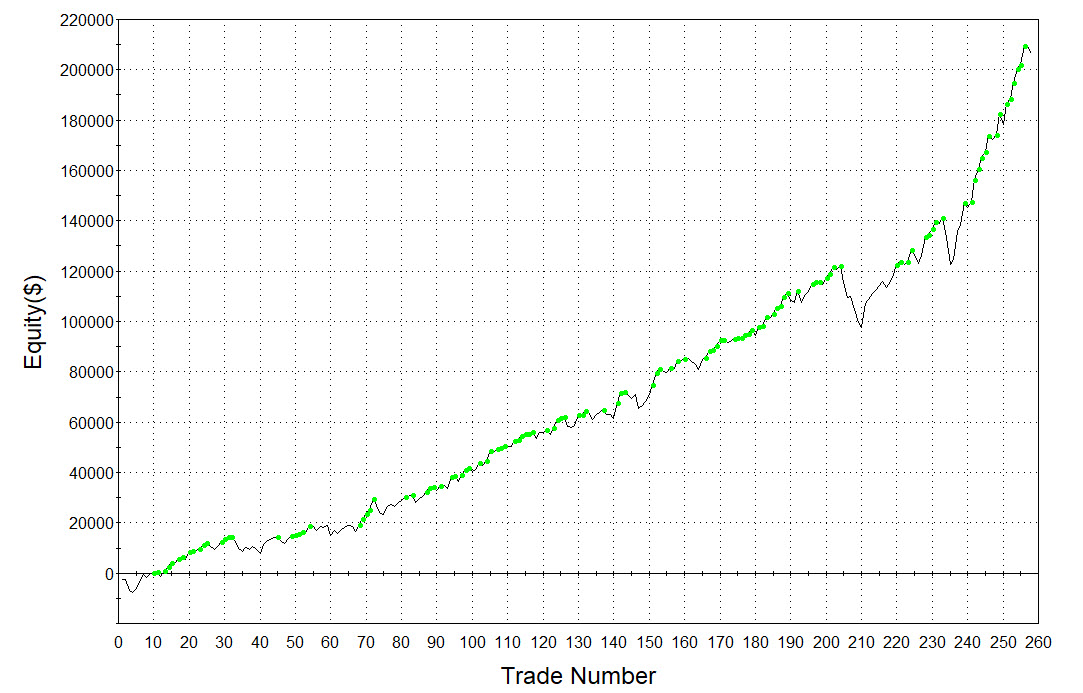

The R-MESA program was written in 1992. It was an intraday program used for trading the S&P index. R-MESA was rated as one of the top 10 S&P trading systems continuously for over 10 years, as rated by Futures Truth.

My goal is to bring the science of engineering and Digital Signal Processing to the art of trading. Toward that end, I have written four books published by John Wiley & Sons and have written over 75 articles for Stocks & Commodities magazine. I introduce my latest research during my annual workshops held in October each year.

It’s refreshing to find new ideas in a business that’s become so competitive and often filled with variations on the same theme.

– perry kaufman

If John Ehlers writes it, I read it. He’s that brilliant.

– larry williams

John is one of those rare breed of analysts who dives into the why and how of thing and not the often used superficial approach.

– Greg Morris

John Ehlers ranks with Art Merrill as the best quantitative analyst of the twentieth and probably the twenty-first century.

– John Sweeney

MESA Workshop

A NO-HOLDS-BARRED LEARNING EXPERIENCE

WHEN: October 18-22 2021

WHERE: On your computer – no travel required

HOW: via WEBEX

PREREQUISITES: Working familiarity with EasyLanguage. High School Algebra and Trigonometry

COST: $4,000

TAKE AWAYS

60 unique advanced indicators in EasyLanguage

12 tested trading strategies in EasyLanguage

4 Blazingly fast Walk Forward Optimizers in EasyLanguage

Disclosed MESA algorithm

16 ONE HOUR MODULES – A LIVE EVENT

Four modules per day after the market close. Open discussion on Friday.

Code distributed before the workshop so you can experience and ask questions.

1. Introduction and Overview

2. Cycle theory and math basics

3. Technical Description of market data

4. Finite Impulse Response filters

5. Infinite Impulse Response filters

6. Smoothing filters

7. Bandpass and Passband Filters

8. Indicators and Transforms

9. Spectrum Estimators (MESA, DFT, etc.)

10 Swami Charts

11. Correlation as a Technical Indicator

12. Predictions

13. Trading Strategy Overview

14. Robust Daily Strategies

15. Robust Intraday Strategies

16. Optimization and WFO

Participation is limited. Reserve your seat now!

No group buys! Group Buy Membership will be canceled and not refunded